Aitkin County Property Tax Records . if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. Processes cash and check transaction. search our database of aitkin county residential land records by address for free, including property ownership, deed. You will receive your tax statement once a year. Provides a value reduction and reduced classification tax rate for property owners who apply and. Collects mortgage and deed tax. Pursuant to minnesota statute 471.701, counties with. By law, all tax statements must be. collects and manages property tax payments. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. When will i receive my tax statement? Notice to the general public. aitkin county assessor's office. The aitkin county assessor's office values and classifies all types of real estate in the.

from aitkin.mngenweb.net

By law, all tax statements must be. search our database of aitkin county residential land records by address for free, including property ownership, deed. aitkin county assessor's office. Notice to the general public. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. Pursuant to minnesota statute 471.701, counties with. Collects mortgage and deed tax. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. Provides a value reduction and reduced classification tax rate for property owners who apply and. Processes cash and check transaction.

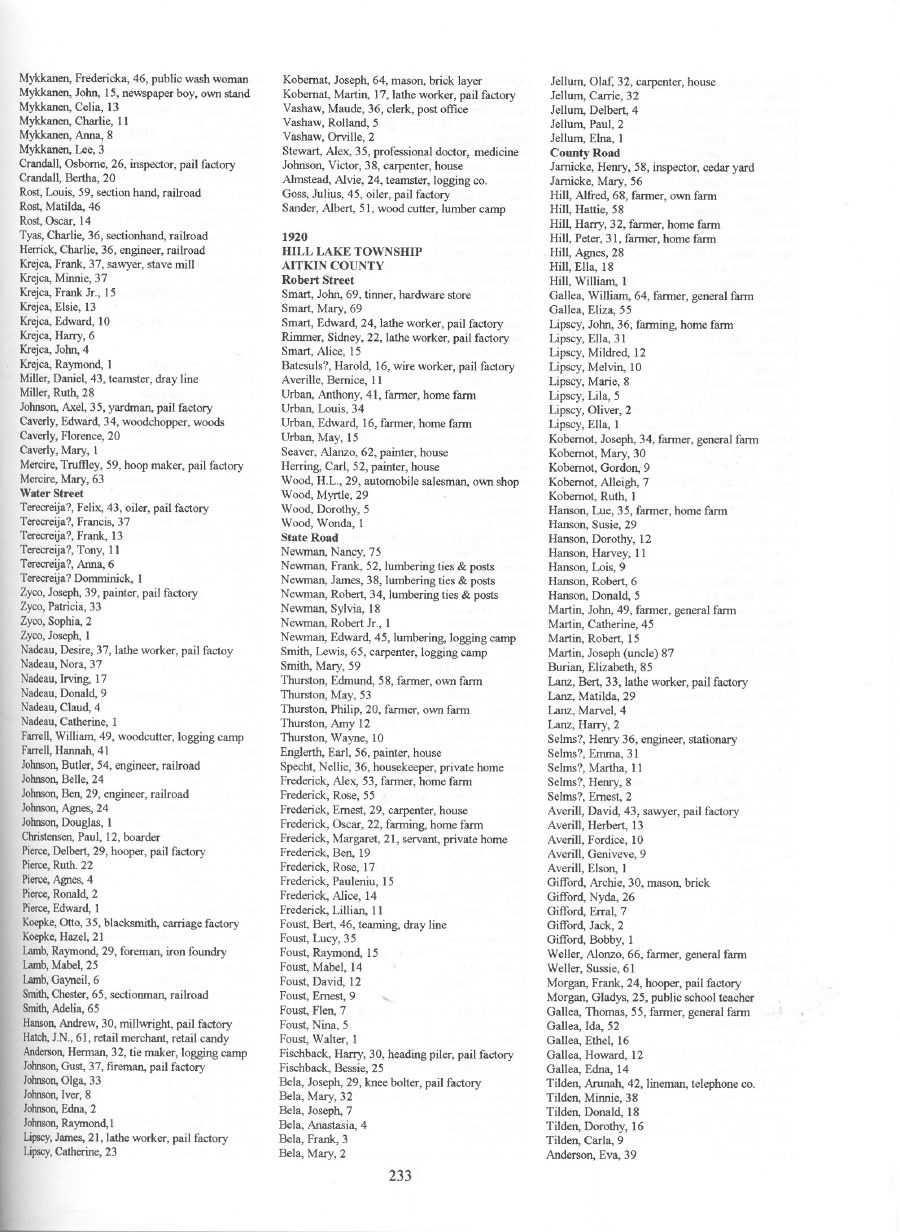

"Census Records, Aitkin County, Minnesota"

Aitkin County Property Tax Records Collects mortgage and deed tax. Processes cash and check transaction. Notice to the general public. search our database of aitkin county residential land records by address for free, including property ownership, deed. By law, all tax statements must be. collects and manages property tax payments. You will receive your tax statement once a year. Provides a value reduction and reduced classification tax rate for property owners who apply and. Collects mortgage and deed tax. aitkin county assessor's office. Pursuant to minnesota statute 471.701, counties with. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. When will i receive my tax statement? The aitkin county assessor's office values and classifies all types of real estate in the.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. Provides a value reduction and reduced classification tax rate for property owners who apply and. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. When will i receive my tax. Aitkin County Property Tax Records.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records collects and manages property tax payments. When will i receive my tax statement? find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. Provides a value reduction and reduced classification. Aitkin County Property Tax Records.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records You will receive your tax statement once a year. Pursuant to minnesota statute 471.701, counties with. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. search our database of aitkin county residential land records by address for free, including property ownership, deed. Processes cash and check. Aitkin County Property Tax Records.

From www.landwatch.com

Aitkin, Aitkin County, MN Lakefront Property, Waterfront Property Aitkin County Property Tax Records You will receive your tax statement once a year. When will i receive my tax statement? Collects mortgage and deed tax. Provides a value reduction and reduced classification tax rate for property owners who apply and. The aitkin county assessor's office values and classifies all types of real estate in the. search our database of aitkin county residential land. Aitkin County Property Tax Records.

From www.dot.state.mn.us

Aitkin County Maps Aitkin County Property Tax Records When will i receive my tax statement? By law, all tax statements must be. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. Notice to the general public. Provides a. Aitkin County Property Tax Records.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records collects and manages property tax payments. Collects mortgage and deed tax. Provides a value reduction and reduced classification tax rate for property owners who apply and. The aitkin county assessor's office values and classifies all types of real estate in the. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. When. Aitkin County Property Tax Records.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records Processes cash and check transaction. search our database of aitkin county residential land records by address for free, including property ownership, deed. collects and manages property tax payments. Collects mortgage and deed tax. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. if a due date falls on a. Aitkin County Property Tax Records.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. The aitkin county assessor's office values and classifies all types of real estate in the. search our database of aitkin county residential land records by address for free, including property ownership, deed. collects and manages property. Aitkin County Property Tax Records.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records Processes cash and check transaction. Collects mortgage and deed tax. When will i receive my tax statement? Pursuant to minnesota statute 471.701, counties with. Provides a value reduction and reduced classification tax rate for property owners who apply and. Notice to the general public. You will receive your tax statement once a year. aitkin county assessor's office. find. Aitkin County Property Tax Records.

From www.landwatch.com

Aitkin, Aitkin County, MN Undeveloped Land, Lakefront Property Aitkin County Property Tax Records You will receive your tax statement once a year. Notice to the general public. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. Provides a value reduction and reduced classification tax rate for property owners who apply and. The aitkin county assessor's office values and classifies all. Aitkin County Property Tax Records.

From www.landwatch.com

Aitkin, Aitkin County, MN Undeveloped Land, Homesites for sale Property Aitkin County Property Tax Records Processes cash and check transaction. You will receive your tax statement once a year. Collects mortgage and deed tax. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. search our database of aitkin county residential land records by address for free, including property ownership, deed. By. Aitkin County Property Tax Records.

From aitkin.mngenweb.net

"Census Records, Aitkin County, Minnesota" Aitkin County Property Tax Records Pursuant to minnesota statute 471.701, counties with. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. You will receive your tax statement once a year. Collects mortgage and deed tax. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records.. Aitkin County Property Tax Records.

From exoxuohlt.blob.core.windows.net

Aitkin County Property Ownership Map at Patricia Mason blog Aitkin County Property Tax Records Collects mortgage and deed tax. When will i receive my tax statement? By law, all tax statements must be. The aitkin county assessor's office values and classifies all types of real estate in the. Processes cash and check transaction. collects and manages property tax payments. Notice to the general public. if a due date falls on a weekend. Aitkin County Property Tax Records.

From idahocapitalsun.com

Want to estimate your property tax bill? The Idaho State Tax Commission Aitkin County Property Tax Records collects and manages property tax payments. Pursuant to minnesota statute 471.701, counties with. search our database of aitkin county residential land records by address for free, including property ownership, deed. By law, all tax statements must be. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business. Aitkin County Property Tax Records.

From lessonmagicgallised.z14.web.core.windows.net

Property Tax Information For Taxes Aitkin County Property Tax Records collects and manages property tax payments. search our database of aitkin county residential land records by address for free, including property ownership, deed. Processes cash and check transaction. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. Notice to the general public. Provides a value. Aitkin County Property Tax Records.

From www.uslandgrid.com

Aitkin County Tax Parcels / Ownership Aitkin County Property Tax Records aitkin county assessor's office. search our database of aitkin county residential land records by address for free, including property ownership, deed. You will receive your tax statement once a year. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. Processes cash and check transaction. By law, all tax statements must. Aitkin County Property Tax Records.

From webbgenealogy.com

Sources Aitkin County Property Tax Records collects and manages property tax payments. find aitkin county property records, including deeds, tax records, boundary records, public records, and zoning records. You will receive your tax statement once a year. Pursuant to minnesota statute 471.701, counties with. Provides a value reduction and reduced classification tax rate for property owners who apply and. if a due date. Aitkin County Property Tax Records.

From www.landwatch.com

Aitkin, Aitkin County, MN Commercial Property, Lakefront Property Aitkin County Property Tax Records collects and manages property tax payments. Collects mortgage and deed tax. By law, all tax statements must be. Processes cash and check transaction. if a due date falls on a weekend or legal holiday, the effective due date moves to the next business date. You will receive your tax statement once a year. When will i receive my. Aitkin County Property Tax Records.